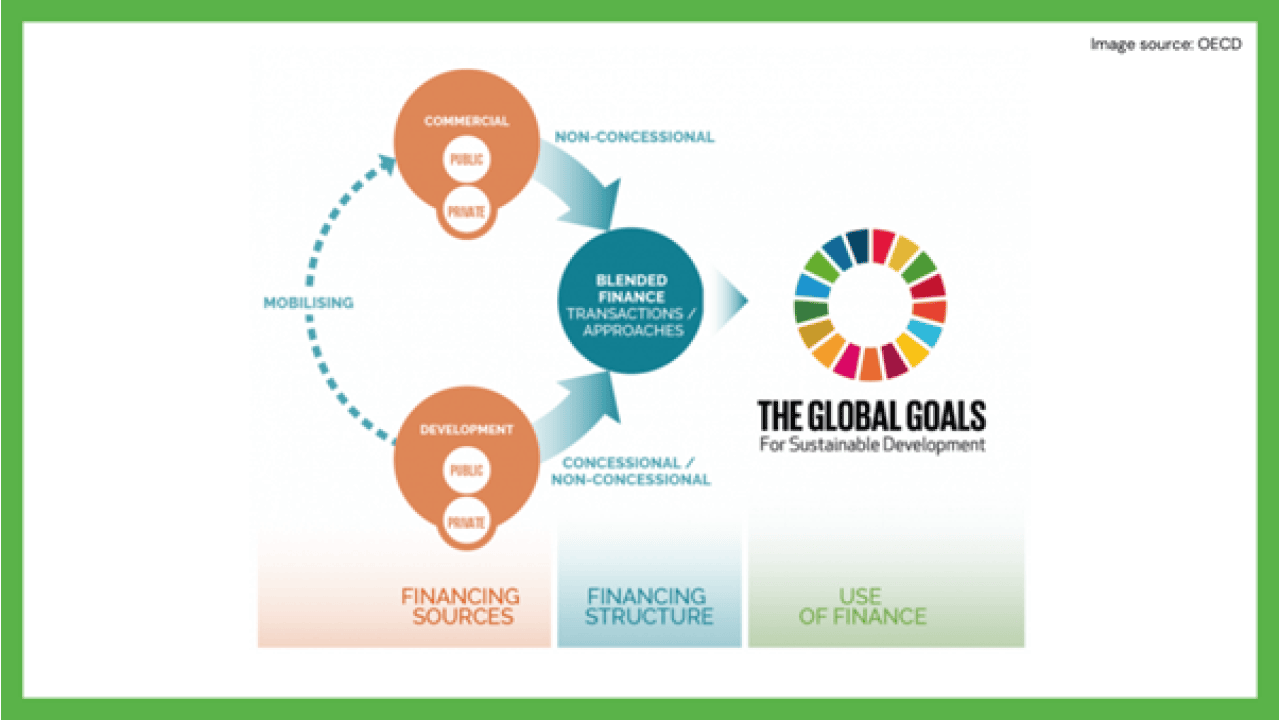

Blended finance is an innovative and promising financing structure that strategically uses public and private funds to mobilize additional private capital for sustainable development projects.

The Development Financing Gap

Developing economies and emerging markets require significant funding to develop infrastructure, reduce emissions, and adapt to the physical effects of climate change. Public resources alone are not sufficient to meet the investment gap required to meet the Paris Agreement and Sustainable Development Goals. Investing in sustainable and resilient infrastructure, including transport, energy, water and sanitation for all, is a prerequisite for achieving many of our goals. Hence, there is an urgent need to mobilize private investments on a large scale to meet our climate objectives. Of the various tools under the Finance for Development (FfD) process, blended finance is a promising tool to provide the sustainable development agenda with additional capital.

What is Blended Finance?

Blended finance is the strategic use of development finance for the mobilization of additional finance towards sustainable development in developing countries. It is a structuring approach that allows organizations with different objectives to invest alongside each other while achieving their own objectives (whether financial return, social impact, or a blend of both). Blended finance is attractive as it shifts the perceived unfavorable risk-return relationship by providing a guarantee to the investor and thereby removing barriers to the investment. Distinguishing characteristics of blended finance transactions are the contributions towards achieving SDGs with an expected positive financial return, where the public and/or philanthropic parties are catalytic.

Importance of Blended Finance

Mobilizes new sources of capital for SDGs: The infrastructure financing gap, despite the combined amount of private capital flows, personal remittances, official development assistance (ODA) and private grants along with public funds, could work against achieving the SDGs in developing countries. Reducing the risk attracts commercial finance.

Breaks barriers between private sector investment and infrastructure projects: Such as when projects are de-risked, they attract more private capital. This “halo effect” can significantly reduce the gap between relative costs of public and private capital, ultimately benefitting the host country.

Builds local capacities: Beyond delivering capital to achieve SDGs, synergies arising due to blended finance can be applied in innovative ways to solve persistent development challenges, build local capacity to assist local markets, and improve local climate investment policies and regulations.

Attend the FPI virtual congress to know more!

The Future-Proof Infrastructure Congress will provide a platform for in-depth dialogue with industry experts from diverse regions, as we explore the potential of blended finance for a curated selection of early-stage bankable infrastructure projects. Through this dialogue, we hope to identify practical solutions that can enable the implementation of high-impact infrastructure projects, while ensuring positive social and environmental outcomes for all stakeholders.

Join the Future-Proof Infrastructure virtual event online on the 28th March as we discuss the progress on Public Private Partnerships and blended finance, perspectives from the public and private sector on FAST and showcase infrastructure projects that feature blended finance and other financial instruments.

Reference links:

- Blended Finance: A Brief Overview

- Addis Ababa Action Agenda

- Blended Finance - OECD

- Blended finance: A game changer for sustainable infrastructure